Planning for retirement – Prepare For Your Golden Years The Right Way

For most of us, retirement planning creates a lot of apprehensions. It seems like there are more questions than answers. What do you need to consider? When should you start planning? How can you tell if your plan is on track or not? Who can help answer these questions for you and who will be honest with the tough decisions that must be made?

To begin to plan for your golden years, you must first take stock of your current financial position. You need to know where you are now and where you want to be in the future. Once you have a clear picture of what needs to be done to get there, then Gilbert Tax Preparation Service can help with creating a solid retirement plan and estate plan that is unique to you.

Your retirement plan should consider your personal situation, time horizon, investment options, and sources of income, among other factors. The right mix of investments for your plan is unique; some people prefer more stock market risk while others want less volatility. A financial professional on our team can help you understand how to get the most out of your money in the months leading up to retirement thanks to over 30 years of experience with accounting, bookkeeping and financial planning. Our team of experts has helped many people just like you prepare and plan for their golden years. Our experience, knowledge, and integrity are hallmarks that set us apart from other firms. We work with you to create a plan that fits your personal needs and goals for retirement. Whether it’s now or closer to your retirement date, Gilbert Tax Preparation Service is here with you every step of the way. At Gilbert Tax Preparation Service, we look forward to helping guide you through your golden years.

Trust the tax professionals

What is Retirement Planning and why does it matter?

Retirement planning is the process of saving, investing, and ultimately distributing money with the goal of maintaining oneself during retirement. Retirement planning considers assets, income, future expenditures, obligations, and longevity. This is in order to determine if a person will be able to retire and how much money they may need. The process is done with the goal of maximizing the quality of life after retirement while minimizing financial stress, uncertainty, and risk.

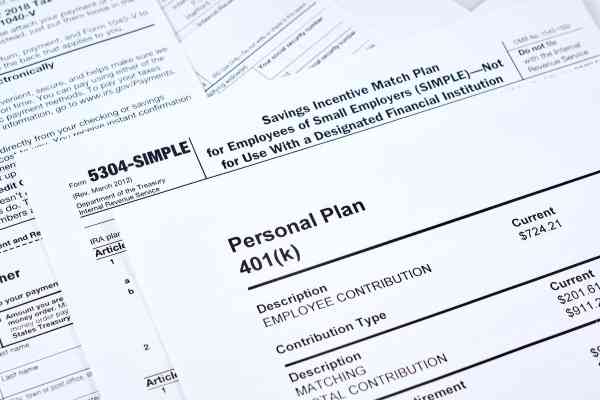

Retirement planning does not just apply to employees at large companies that offer plans such as 401(k)s or pensions. It can apply to anyone who may retire or expects to retire, such as those at or near traditional retirement age. Self-employed individuals and small business owners would also benefit from a solid retirement plan, as they have no employer to provide a platform for growth.

People often receive their first exposure to retirement planning through their parents who encourage them to start saving for retirement as soon as they begin working. Those that are educated about the importance of planning early can help reduce their anxiety by setting up auto-enrollment programs, which lead to compounded growth over time.

Retirement planning is not always easy, but there are many tools available to help make it simpler. Companies like Gilbert Tax Preparation Service can help individuals understand their options and create a specific plan for them.

We will help you on addressing the following questions:

- How much money do I need to retire?

- Can I meet my yearly expenses if I retire early?

- Are there ways to reduce my current tax obligations?

- Will being in or out of the workforce affect my eligibility for benefits, such as Medicare?

- What are the advantages of signing up for 401(k) early?

Understanding these questions is the first step to being confident in your retirement, so let us help you get started. By becoming more knowledgeable about the process of planning for retirement, you can then set out to meet your goals with confidence.

How Much Does a Retirement Planner Cost?

Retirement planning is an investment in your future. But, just like with any other form of investing, you should consider assistance from the services of someone who can help you plan for retirement. How do you know when that cost is worth it?

As a starting point, asking yourself if the service being offered will be worth its weight in gold is a good idea. Ask, “Does the company offer quality services?” Look for answers that indicate they can help you reach your goals and maximize your savings by maximizing returns on investments, evaluating current plans, making tax-efficient decisions, and providing advice on estate planning.

But just to break the ice, on average, financial advisors charge 1% of the assets they manage for their clients. And when you consider that many people have $250,000 or more to invest, that starts to sound like a bargain compared to what you might pay in fees to someone else who wasn’t looking out for your best interests.

Here at Gilbert Tax Preparation Service, we make sure to tailor your accounts to fit your specific needs. Our services are not only affordable but also efficient and secure so that you can rest easy knowing your interests are being looked after. We at Gilbert Tax Preparation Service have over 30 years of experience in the financial industry and have worked with hundreds of clients to provide financial advice and retirement planning. We understand that each individual’s needs are different, so we work with them to create a plan that meets their specific goals.

Does Retirement count as an Investment?

Retirement can be considered an investment; it has the potential to provide people with benefits that they will enjoy for the rest of their lives. Since retirement is technically a type of investment, it makes sense that traditional investments like stocks, bonds, and mutual funds should be part of one’s retirement portfolio.

Is real estate considered an investment?

Most people associate real estate with the idea of investing because it has tangible value and can be rented. For many, worrying about retirement is like worrying about tomorrow; even if one plans adequately today, there’s no guarantee that his or her goals will be met without some kind of action.

When it comes to real estate, it makes sense to diversify investments in order to reduce risk. Stocks and bonds are not the only kinds of assets that may be considered “safe” investments; real estate can also fall into this category.

Retirement planning is complex enough as it is, so there’s no need to worry about how or where your retirement funds should be invested. Instead, just work with our professionals that understand your specific needs and circumstances. Let our team help bring your vision to life through calculated decisions.

What Information Do We Need to Start on Your Plan?

The more information that you can share with us, the better equipped we will be to create the perfect plan for your unique needs. The first thing that you should do is gather all of your records so that no detail goes unnoticed. This includes tax returns, investment statements, bank accounts, loans, mortgages, or other types of debt, and any other relevant information.

We will also get an accurate idea of how much you stand to receive through benefits. There are many factors involved in determining how much income one might expect during retirement, so let our experts handle the challenge while you enjoy the benefit of knowing that you are in good hands and on your way to achieving your goals. Also, you might want to answer this question before you visit our office:

- What are my goals for retirement? – Whether you want to travel or simply wish to golf every day, let us know so that we can help illustrate the best way to achieve your dreams.

- When would I want to retire?

- What kind of retirement do I desire?

- Do I intend to work in retirement?

- How am I going to pay for my children’s college education?

- Who will get my money if something happens to me?

Knowing the answers to all these questions yourself will allow you and us to have a clearer view of what you need to do in order for you to achieve your goals.

The benefits of hiring someone for retirement planning

Retirement can be a scary time, as it’s the perfect opportunity for people to spend their hard-earned money on things such as travel. The last thing that anyone wants is to put themselves in debt by pursuing experiences far beyond what their means allow. This is why it pays to work with experts who understand your needs and can help you achieve your dreams.

The goal of Gilbert Tax Preparation Service is to put the power back in the hands of those who know what they want, and how to get there. Once we have a clear picture of where you stand financially and your goals, we will work tirelessly to create a plan that allows you to enjoy your golden years with peace of mind.

Contact Us Today for all your tax preparation needs!

If you’re ready to work with a team that will treat your personal information with care and discretion, then Gilbert Tax Preparation Service in Gilbert, AZ is the ideal choice. We are here to guide you along the way toward creating a plan that ensures your success during retirement. Call us today for more information on how we can help!

FAQS About Retirement Planning

Tax Preparers in Gilbert, AZ

Call today to learn more about how our accounting services can benefit your business.

Get In Touch With Our Tax Experts

You don’t have to go through the tax season alone. Gilbert Tax Preparation Service is here to help. Contact us today to schedule a free consultation and see how we can make tax season a little less stressful.